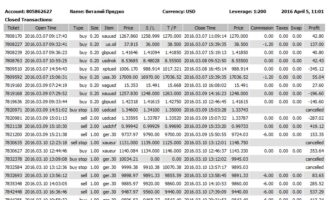

An alternate passive trading approach exists via the IronFX AutoTrade platform, where traders copy entire strategies. I like the details IronFX provides for each strategy and signal provider. One fixed spread account exists with commissions between $18.00 and $43.00 per round lot. Traders should avoid all account types, except Absolute Zero, as trading costs elsewhere remain excessive. One of the most ignored trading costs is swap rates on leveraged overnight positions.

Compare Online Investing Brokers for 2023 • Benzinga – Benzinga

Compare Online Investing Brokers for 2023 • Benzinga.

Posted: Sun, 29 Sep 2019 09:42:50 GMT [source]

As IronFX operates instant execution accounts, there remains the potential for conflict of interest; but the availability of market execution accounts should satisfy any concerned traders. UK residents will be trading under the subsidiary, Notesco Ltd , authorised and regulated by the FCA in the United Kingdom. In fact you can choose whatever you want, as all of them suit positional traders. Those ones interested in opening long-term positions, should be ensured with quite small spreads, however, it’s’ not really crucial as to scalpers for example. That’s why there is no obvious difference among all the presented account types for investors.

IronFX Review 2022: A Must Read Before You Trade

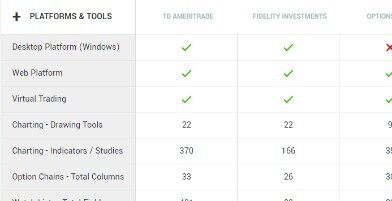

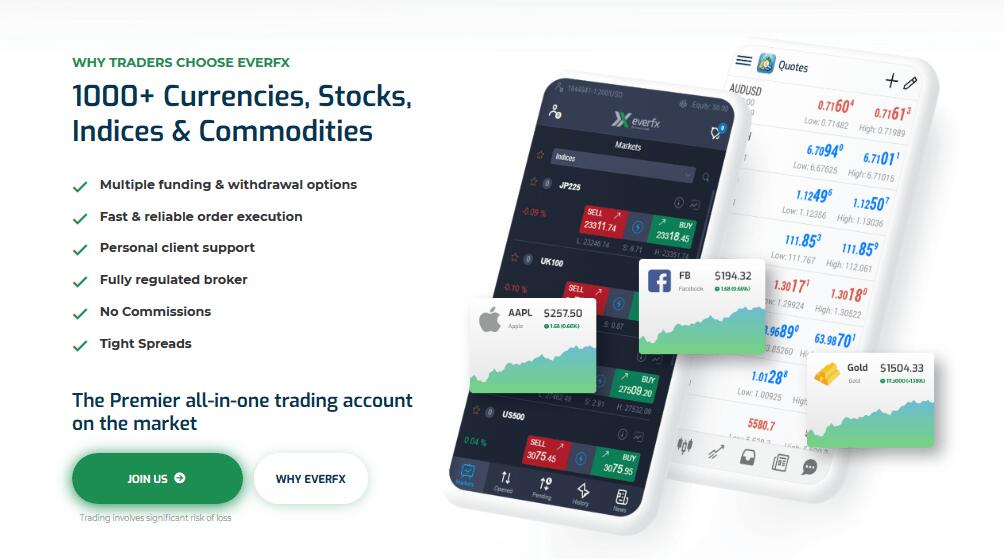

This is an MT4 broker with a relatively wide range and large number of markets to trade for this kind of broker. The trader can trade markets such as Spot and Currency Futures, Soft Commodities on MetaTrader 4 and use its powerful features to trade these markets. MT4 supports both automated and non-automated trading, however IronFX BM additionally lets the trader autotrade using the social and copy trading platform Myfxbook. Traders can additionally open an account in and fund their account with Bitcoin, Ether and ADA. IronFX is an excellent broker for beginners to intermediate traders. They provide the MT4 trading platform, as well as a variety of products and competitive spreads and leverage levels.

This information will allow you to know if a broker can provide full support when you need it. IronFX received a very high score for Tradable Instruments in our rating as the broker offers a high number of forex pairs, commodities, and indices. The mobile app does not provide all the options offered by the desktop version, but it is sufficient enough to satisfy the needs of traders who must make their decisions on the go. The app is intuitive so traders should not have problems with it.

Can I Withdraw IronFX Bonus?

Also, there are many videos and tutorials available on the web in case you have questions about certain features of the app. Both beginners and advanced traders will have plenty of options to choose from when developing their trading strategy. IronFX has a 3% “no trading” fee, which is applied in case the trader deposits and withdraws funds without ever making a trade.

- I downloaded and tried it out for a few days, and I really liked all the features it offered, its design and how properly it worked.

- The responses arrive in a prompt and efficient manner from my experience.

- The four-step account opening process is fully digital and accounts are generally ready for trading in one day.

- IronFX actually offers seven different trading accounts, including a swap-free Islamic trading account.

- They have very dodgy withdrawal policy and you will never see your money again.

Firstly, the company has two entities – one regulated in Cyprus and the other one based offshore in Bermuda. It’s important to mention that the offshore company has no license whatsoever and has a branch in Gibraltar as well. Hence, you should be cautious when registering and check well under which entity you belong. IronFX is a long-lasting brokerage, present on the financial market for over a decade.

Account

Our research found that IronFX is a reliable and trustworthy broker committed to providing clients with a transparent trading environment. IronFX’s Futures CFDs grant traders access to global markets. With low trading costs and tight spreads, investors can take advantage of rising trends or short positions for maximum returns.

Exclusive: Cyprus Consumer Protection Agency Condemns IronFX Over Bonuses – Finance Magnates

Exclusive: Cyprus Consumer Protection Agency Condemns IronFX Over Bonuses.

Posted: Wed, 17 Jan 2018 08:00:00 GMT [source]

Overall, IronFX’s non-trading fees are high when compared to other brokers. When making this calculation, we use one lot of EUR/USD as a benchmark as it is the most commonly traded currency pair and it usually has the tightest spread. And I am sure that other clients also appreciate such help. In its current form, IronFX is recovering from a series of missteps. When it launched in 2010, it provided a significantly better trading environment.

Read our IronFX Review and Discover More About a Broker Offering More than 3,000 Instruments.

There is an unspecified commission on Zero Spread accounts, while no commission is charged on the other accounts. The IronFX School has absolutely everything under the sun, and that’s why we feel the need to point it out in our IronFX review. Its attention to detail and educational ability is fantastic, and we believe there are very few places you can learn how to trade than at the IronFX School. They also have deposit insurance, ensuring that you state your name and provide legal documents, as well as direct deposit funds through a registered source to ensure it’s a legitimate deposit.

Such analysis and ideas are useful for beginner traders who can watch the whole process of the creation of a trading plan. Traders also have access to three STP/ECN accounts.STP means “straight-through processing”, when orders’ are routed to liquidity providers. ECN means “electronic communication network”, when the network is used to match orders between buyers and sellers. A hybrid STP/ECN model is a combination of STP and ECN, which improves customer service. You may discover that there are hidden fees, or that withdrawal times are longer than you anticipated. We check these factors and others so you know what to expect when trading with this broker.

IronFX Reliability & Safety of Funds

Between 74-89% of retail investor accounts lose money when trading CFDs. IronFX offers a great fit for traders at low to medium skill levels, with flexible account types that suit many investment and trading styles. Money managers can also benefit from a personal multi-account manager that allows trading of multiple Metatrader accounts. Professionals trading their own accounts may wish to look elsewhere, despite tiered pricing, due to the lack of volume discounts or a proprietary high-end trading platform. I cherish the company for a precise information of how to commence trading with it. Plus, it provides a complete data about available assets, leverages, account types and trading platforms.

IronFX BM is a MetaTrader 4 broker, with a relatively wide and large number of markets to trade (300+), for this kind of broker. IronFX focuses only on this platform, thus for MT4 traders, IronFX BM may be worth considering. The IronFX broker gives you several bonuses according to the deposits you make, but keep in mind that the VIP account is paid. Cash Rebate bonus – Usually this type of a bonus on Forex broker is offered to the more experienced and advanced customers. The bonus gives you 3 $ on every lot you trade, when you have over 500 lots and 2 or 2,5 $ on smaller amount of lots.

Both cryptocurrencies and CFDs are complex instruments and come with a high risk of losing money. Research options provided by brokers may not be seen as the most important feature for some traders, but they can give you an edge over the competition. Staying on top of important market news announcements and being aware of big themes can be very helpful. The rating system provides a clear picture of how well your broker fulfills this service. This selection of options is more than sufficient enough for mobile-based trading. Typically, the mobile app is used when the trader does not have access to the desktop platform but needs to monitor the market and open positions.

Petros Kalaitzi leaves NAGA Group to join TheTradingPit – FinanceFeeds

Petros Kalaitzi leaves NAGA Group to join TheTradingPit.

Posted: Thu, 03 Feb 2022 08:00:00 GMT [source]

Clients can choose between two types of floating and an equal number of fixed accounts that offer different spread schedules and fee structures. Several account types allow retail clients to bypass IronFX’s dealing desk, which carries a systematic conflict of interest, and trade directly with the interbank system. Accounts are tiered into Micro, Premium, and VIP levels, depending on capital commitment, with spreads dropping on major Forex pairs between tiers. We’re delighted to hear that you found our registration and account verification process to be simple and straightforward. At IronFX, we understand the importance of keeping our clients’ personal and financial information secure, and we take every measure to ensure that this data is protected.

They were unable to answer many of our questions and seemed generally confused. IronFX’s blog content is curated by IronFx’s in-house analysts and is updated frequently. The blog content is a mixture of educational materials, explaining concepts such as technical and fundamental analysis, and also provides an overview of the markets. IronFX allows accounts to be denominated in 13 different base currencies, depending on the account chosen. This is a wider range than is typically seen at most other brokers.

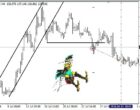

Here is a screenshot of quotes at IronFX during the London-New York overlap session, the most liquid one, where traders usually get the lowest spreads. IronFX lacks transparency in describing its products and services, making frequent contact with customer service necessary. Personally, I was not very impressed by trading with IronFX. Yes, the brokerage has very profitable and interesting trading conditions, but there is still a lot to work on. IronFX is an excellent choice for those looking for competitive spreads and fees when trading online. IronFX Virtual Private Server is a robust and secure hosting solution for traders who want to trade Forex CFDs confidently.

The company has 8 offices worldwide, and can provide excellent customer support in many different languages. Hello Vrishni, Thank you for taking the time to share your positive feedback about your experience with IronFX! We are thrilled to hear that you feel comfortable with our services and that your overall evaluation about us is positive. 🤩😃 As a client-centric company, we are always looking for ways to improve our services and enhance your trading experience. Currently, we offer two trading platforms, MT4 & Copy Trading with TradeCopier. 👀 Please log into your account for more information or email us at Glad to help!

It is a modern and new brokerage firm in the market, but it has gained huge market popularity with its advanced services. IronFX offers a range of account funding and deposit methods, including local bank transfers, debit cards/credit cards, Bitcoin payments, and various eWallets. Deposits are free on all funding methods and are processed within 24 hours, which is around the industry average. However, it takes 48 hours on average for IronFX to process withdrawals, which is longer than most other brokers. IronFX charges admin fees on some withdrawal methods in addition to a fee of 50 USD for bank transfers under 300 USD.

Trading leveraged products such as Forex and CFDs may not be suitable for all investors as they carry a high degree of risk to your capital. I myself had similar situations with several brokers in my life. Customer support is available 24/5, in 30 different languages to support clients from over 180 countries in Europe, Asia, the Middle East, Africa, and Latin America. IronFX’s research and analysis materials are more comprehensive than its education section, but compared to other large international brokers, are still lacking. Overall, although IronFX offers a wide range of informative video content, the materials generally lack substance and are not well-structured.

75.35ironfx review investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. We continuously invest in product innovation and company personnel to meet the needs of our clients by delivering bespoke quality and unrivaled level of high-quality services. We’re glad to hear that you found the account options suitable for your trading style and preferences.

With each type, the https://forexhero.info/ is lowering, while on the offshore website, all accounts can be swap-free. However, the minimum deposit is not specified for any accounts, which is odd for a regulated brokerage house. For those of you who are of Muslim faith, I am pleased to say that the broker does have swap-free accounts which comply with Sharia law. It’s great that they serve clients from all different backgrounds and with different religious beliefs. However, as with demo accounts this is something that you would expect from all brokers nowadays. If you are new to trading online, then you will be pleased to find a demo account option.

IronFX is noteworthy for providing tight spreads as well as excellent execution with no slippages and requotes to its customers. The broker’s trading servers are optimized in ten different global locations so they guarantee stable and rapid execution of the clients’ trading orders. With recent expansion, IronFX has started operation worldwide, from New York, London to Sydney, altogether in over 20 countries. The company’s activities fully comply with the European Markets in Financial Instruments Directive and are authorized and regulated by the FCA, CySEC and ASIC.